Break-even Tools

- Home

- >

- Break-even Tools

Break-even Accounting Essentials for the Construction Industry

The construction industry faces unique financial challenges, with large-scale projects and substantial upfront investments. AZABIZ’s break-even tools are tailored to address these challenges, offering solutions that help construction businesses thrive.

The Importance of Calculating Break-even Point in Construction

In the construction sector, understanding the break-even point is crucial for project viability. AZABIZ’s break-even point calculator and analysis tools provide accurate predictions, helping to balance books, recover costs, and ensure no loss on projects. These tools allow construction managers to plan with greater confidence, ensuring that each project is both structurally and financially sound.

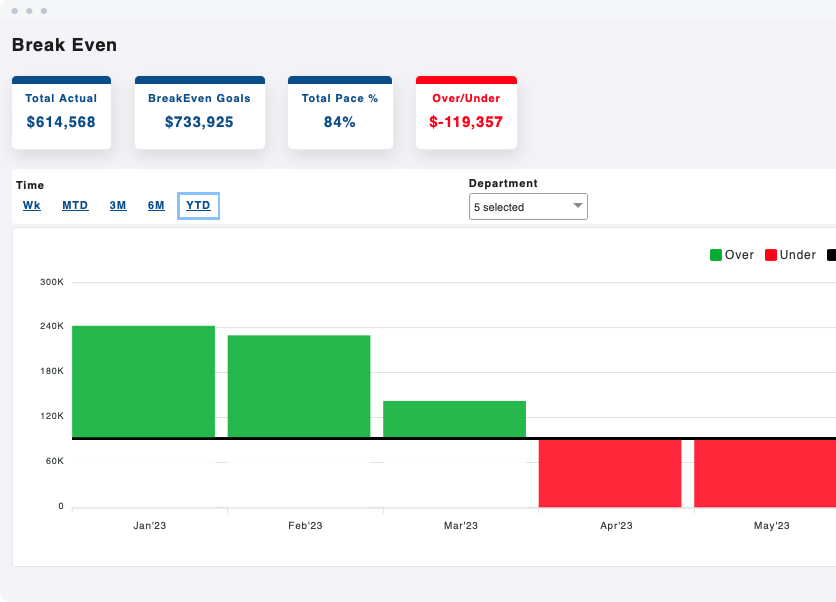

Visualizing Profit Margins with Break-even Charts

Our break-even charts offer a clear visual representation of when construction projects will start to turn a profit, playing a key role in financial planning and decision-making. These charts help in identifying the critical point where revenues begin to exceed costs, guiding strategic decisions and investment planning.

Tailored Break-even Solutions for Home Service Providers

Home service businesses, characterized by their direct customer interactions and varied service offerings, require a nuanced approach to financial planning.

Mastering Break-even Analysis for Home Services

For home service businesses, break-even analysis is essential for setting competitive prices while ensuring cost recovery. Our software simplifies this process, helping businesses to equalize expenses and income efficiently. It’s a powerful tool for small and medium-sized enterprises looking to optimize their pricing strategies in a competitive market.

How to Find the Break-even Point in Home Services

Using our break-even point calculator, home service providers can easily determine the number of services or projects needed to cover their costs and start making a profit. This insight is crucial for businesses aiming to grow sustainably while maintaining a strong customer base.

Strategic Financial Management in Food Service with Break-even Tools

The food service industry operates on tight margins, making effective financial management essential for success.

Break-even in Sales: A Formula for Food Service Success

The food service industry can benefit greatly from understanding their break-even in sales. Our tools help in applying the break-even sales formula effectively, ensuring that every dish sold contributes to covering costs and achieving profitability. This approach helps restaurants and food service businesses to strategize menu pricing and sales targets accurately.

Break-even Analysis Formula: Optimizing Food Service Pricing

Learn how to calculate the break-even point with our detailed analysis formula, tailored to the unique dynamics of the food service industry. This tool is invaluable for those in the industry looking to balance cost management with quality service.

Break-even Economics for Professional Services

Professional services, including consulting, legal, and accounting firms, demand a sophisticated understanding of financial metrics.

Defining Break-even Point in Professional Services

In professional services, the break-even point definition extends beyond simple cost recovery. Our software helps these businesses understand how to balance their service offerings with operational costs for maximum profitability. It’s an essential tool for businesses aiming to optimize their service delivery models while maintaining financial health.

Break-even Equation: A Tool for Professional Growth

Utilize our break-even equation to plan for growth, expansion, and financial stability in the competitive landscape of professional services. This tool helps in setting realistic goals and measuring progress effectively.

Advanced Break-even Analysis for the Medical Sector

Medical practices and healthcare providers face unique financial challenges in delivering quality patient care.

Implementing Break-even Analysis in Medical Practices

Healthcare providers can use our break-even analysis tools to determine the optimal number of patient visits and treatments needed to recover costs and sustain operations. This analysis is vital in a sector where balancing financial viability and patient care is of utmost importance.

Break-even Point Formula for Healthcare Financial Health

Our break-even point formula is specifically designed to help medical practices balance patient care with financial viability, ensuring a stable and profitable healthcare service. This tool aids in managing the financial aspects of healthcare provision without compromising on patient care quality.

Empowering Small Businesses with Break-even Calculation Tools

Our break-even calculation tools are designed for small businesses across all sectors, providing them with the insights needed to make informed financial decisions and achieve their break-even points efficiently. These tools are an essential part of the financial toolkit for small businesses aiming to grow and succeed in a competitive environment.

The Break-even: A Key Metric in Business Planning

Understanding ‘the break-even’ is crucial for any business. Our software makes this process straightforward, providing clear insights into when a business can expect to start seeing profits. This understanding is key to strategic planning and long-term financial success.

Simplifying Break-even with User-Friendly Calculators

Our user-friendly break-even calculators make it easy for businesses of all sizes and sectors to perform complex financial analyses, ensuring that they can quickly and efficiently find their break-even points. These tools are designed with usability in mind, making them accessible to business owners regardless of their financial background.

Comprehensive Break-even Charts for In-depth Analysis

Break-even charts provided by our software offer an in-depth analysis of cost, revenue, and profit margins, assisting businesses in visualizing their path to financial success. These charts are a powerful tool for understanding the financial dynamics of a business and planning for future growth.

FAQs: Everything You Need to Know About AZABIZ

AZABIZ’s break-even analysis software is a game-changer for the construction industry, offering precise calculations and forecasts to ensure project viability and profitability. By accurately determining the point at which costs and revenue balance, our tools help project managers and contractors identify the minimum quantity of work needed to avoid losses, allowing for more strategic financial planning and risk management. This critical insight not only aids in securing project success but also enhances competitive bidding and cost control strategies, making it an indispensable tool for construction financial management.

Our break-even charts serve as a vital visual tool for construction financial planning, providing a clear representation of profit margins and the path to profitability. These charts detail how variable and fixed costs relate to overall revenue, illustrating the financial dynamics of construction projects. This visual aid supports strategic decision-making by highlighting the impact of cost changes on profitability, enabling construction businesses to adjust their strategies in real-time. The clarity provided by our break-even charts ensures more informed, data-driven financial planning, crucial for sustaining and growing a construction business in today’s competitive environment.

For home service businesses, understanding and applying break-even analysis is essential for setting prices that are competitive yet ensure cost recovery and profitability. AZABIZ’s break-even analysis software simplifies this complex process, allowing providers to easily calculate how many services or projects are needed to cover operational costs. This empowers businesses to strategically price their services, enhance financial stability, and pave the way for sustainable growth. By incorporating our software into their financial strategy, home service providers can confidently navigate the balance between competitive pricing and financial health.

Utilizing AZABIZ’s break-even point calculator enables home service providers to effortlessly determine the number of services required to meet and surpass their operational costs. This tool is specifically designed to accommodate the unique cost structures and pricing strategies of the home services sector. By inputting basic financial information, providers can receive a clear, concise calculation of their break-even point, facilitating smarter pricing and service strategies. This not only aids in achieving financial equilibrium but also in planning for profit generation, making it a valuable asset for any home service business aiming for growth.

In the highly competitive food service industry, understanding the break-even point in sales is vital for ensuring that each menu item contributes toward covering costs and achieving profitability. AZABIZ’s tools aid businesses in applying the break-even sales formula effectively, allowing for the strategic pricing of dishes and management of food costs. This analysis ensures that businesses can maintain slim profit margins while still attracting customers with competitive prices. By mastering break-even in sales with our software, food service businesses can navigate the challenges of cost management and pricing strategy, steering towards financial success.

Our break-even analysis formula offers food service businesses a tailored solution to calculate the precise point at which they recover costs and start making a profit. This specialized approach takes into account the unique dynamics of the food service industry, including variable food costs, fixed overheads, and fluctuating sales volumes. By providing a clear methodology for determining break-even points, our software empowers businesses to set prices that ensure both competitiveness in the market and financial viability. Leveraging this formula helps in optimizing menu pricing, managing costs effectively, and strategizing for profit maximization in the food service sector.

The break-even equation provided by AZABIZ is a powerful tool for professional services firms aiming for growth and financial stability. It offers a methodical approach to balancing service offerings against operational costs, facilitating strategic pricing and service development that aligns with market demands. This equation serves as the foundation for financial planning, helping businesses to project future profitability, manage resources efficiently, and make informed decisions about expansion and scaling. With AZABIZ’s break-even tools, professional services can achieve not just financial equilibrium but also set the stage for sustainable growth and competitive advantage in their industry.

Healthcare providers can significantly benefit from implementing break-even analysis using AZABIZ’s specialized tools. Our software assists medical practices in determining the optimal number of patient visits and treatments necessary to cover operational costs and maintain financial health. This analysis is crucial for balancing the provision of high-quality patient care with the need for financial sustainability. By understanding their break-even point, healthcare practices can make strategic decisions about service pricing, cost management, and resource allocation, ensuring the practice thrives financially while delivering exceptional care.

AZABIZ’s break-even calculation tools are designed with small business needs in mind, offering a detailed yet easy-to-understand analysis of when your expenses and income will balance out. By inputting your specific financial data, our software delivers personalized reports highlighting your break-even point. This crucial insight enables small businesses to make strategic adjustments in pricing, cost management, and sales strategies to achieve profitability sooner. Our comprehensive tools not only aim to simplify financial analyses but also empower business owners with knowledge, enabling them to navigate the complexities of their financial landscape with confidence. Incorporating our break-even tools into your business planning can significantly enhance decision-making, helping to optimize operations and drive growth. With AZABIZ, small businesses gain access to big-picture financial analytics tailored to their unique contexts, ensuring they are well-equipped to make informed decisions that propel them toward their financial goals.

Choosing AZABIZ for your break-even analysis and financial planning needs positions your business for success by harnessing precision, user-friendliness, and comprehensive insights. Our software is developed with the latest technological advancements, offering an intuitive interface that simplifies complex financial data into actionable insights. This means businesses of all sizes can easily understand their financial standing, identify when they will break even, and plan accordingly to enhance profitability. Beyond just software, AZABIZ partners with you, offering support and guidance to navigate your financial journey. Our commitment to your success is reflected in our continuous innovation and dedication to providing solutions that address the unique challenges faced by businesses today. By integrating AZABIZ’s break-even analysis tools into your financial strategy, you’re not just gaining access to software; you’re embracing a partnership that is committed to achieving your business objectives. Let AZABIZ guide you through every step of your financial planning, ensuring your path to financial success is clear, navigable, and strategically sound.

Why AZABIZ is Your Ideal Partner for Break-even Analysis

Choosing AZABIZ means opting for precision, ease, and comprehensive financial analysis. Our break-even tools are designed to guide businesses in achieving their financial goals, making us an ideal partner for your financial planning needs.

Whether you are in the construction, home services, food service, professional services, medical, or any other sector, AZABIZ’s software empowers you to break-even, recover expenses, balance books, and experience no loss. Visit our Break-even Point Analysis Software page to explore the benefits and get started on your journey to financial success.